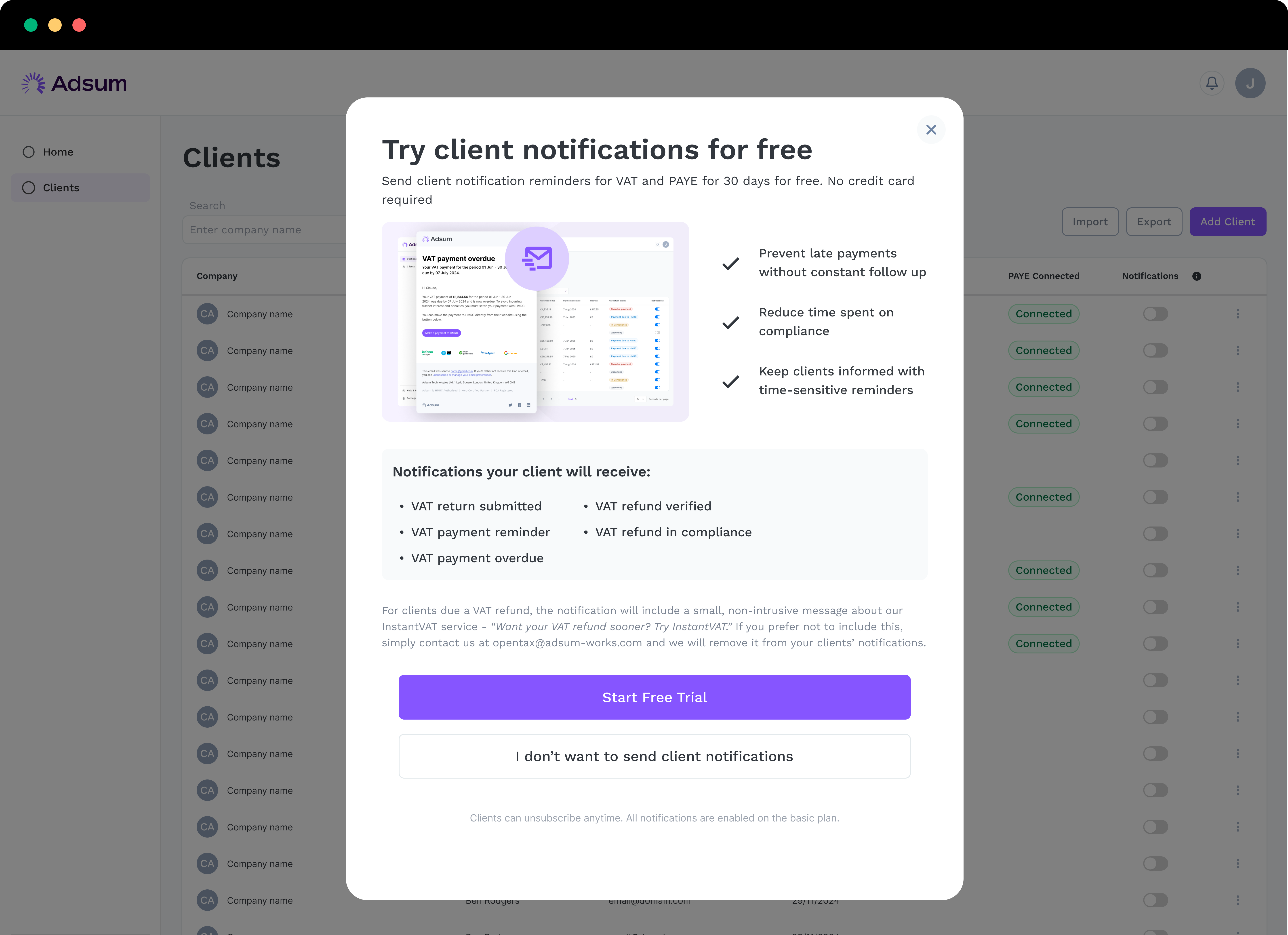

Client notifications img

Keep your clients on track

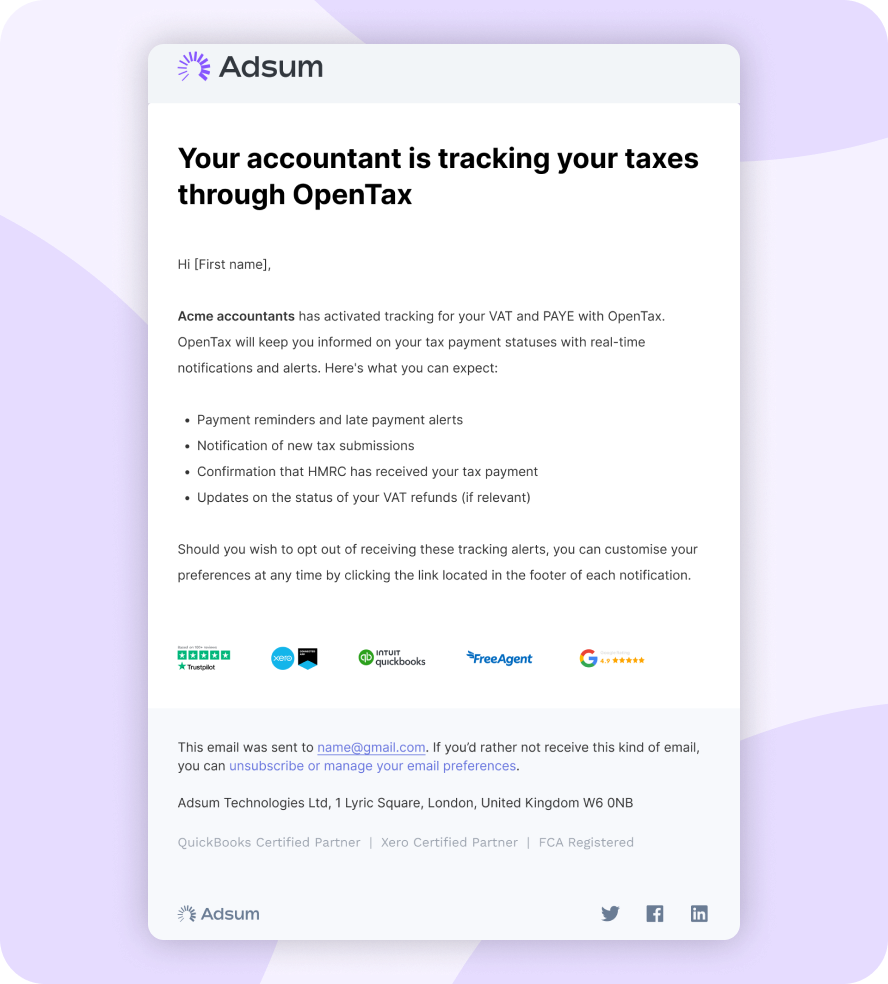

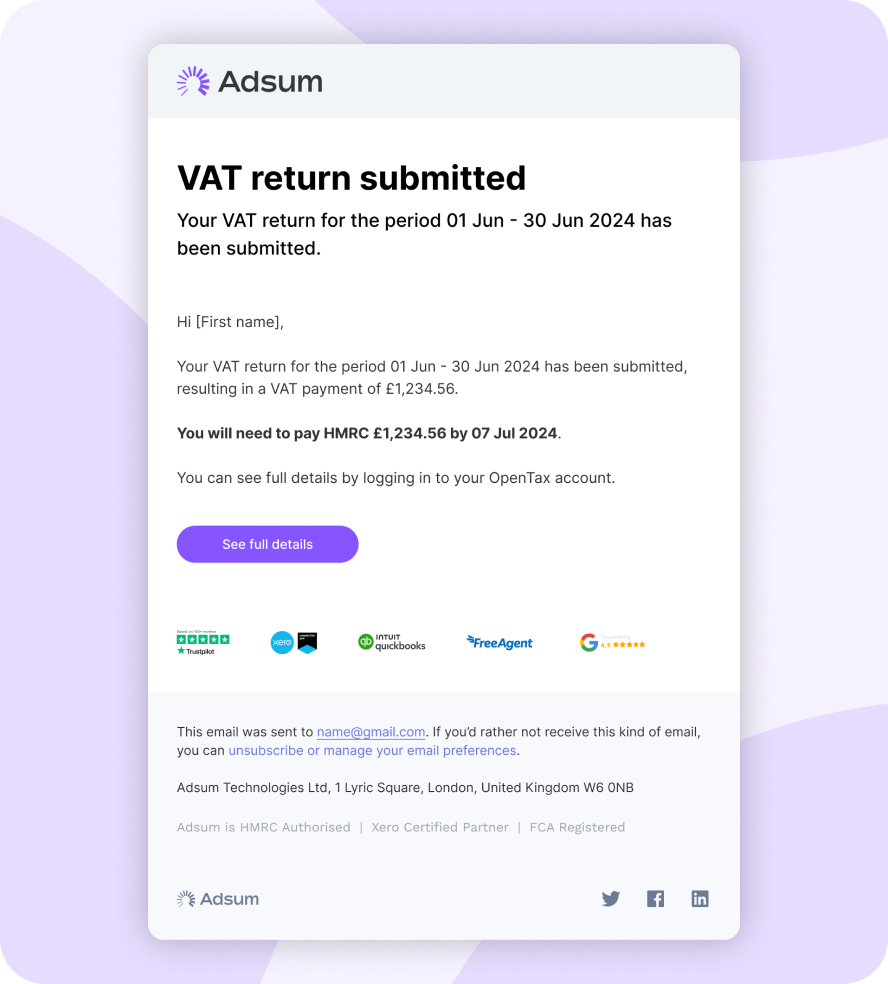

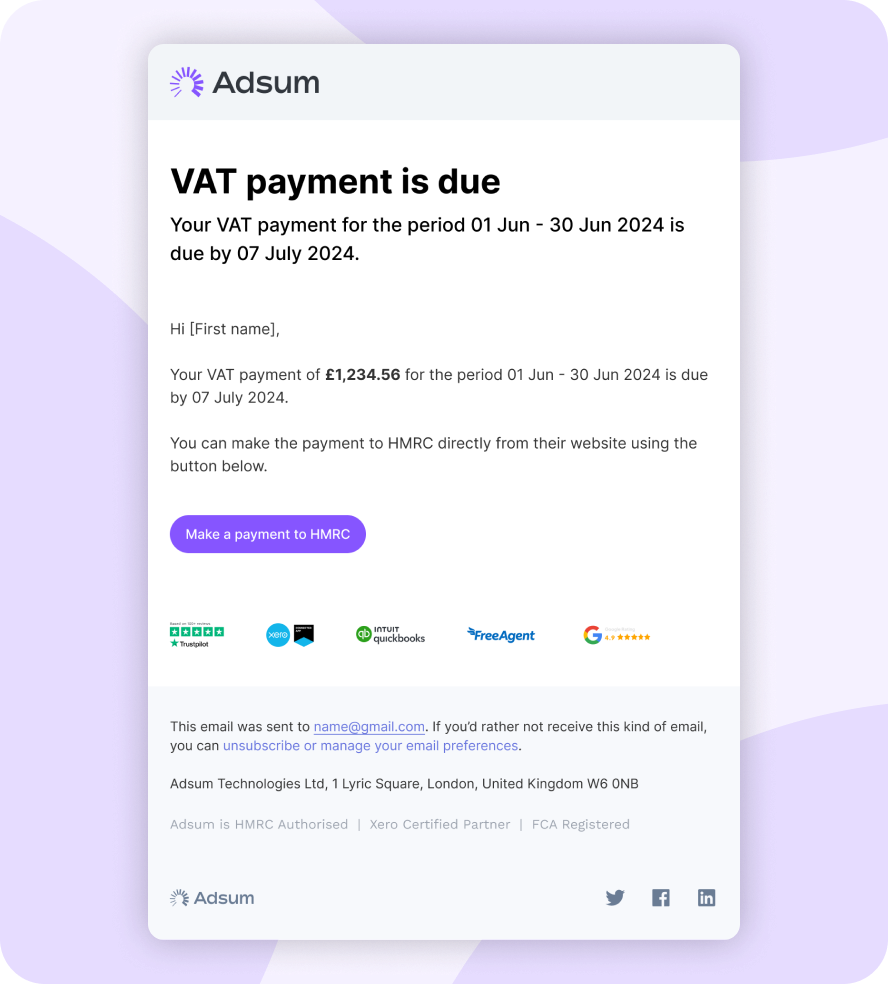

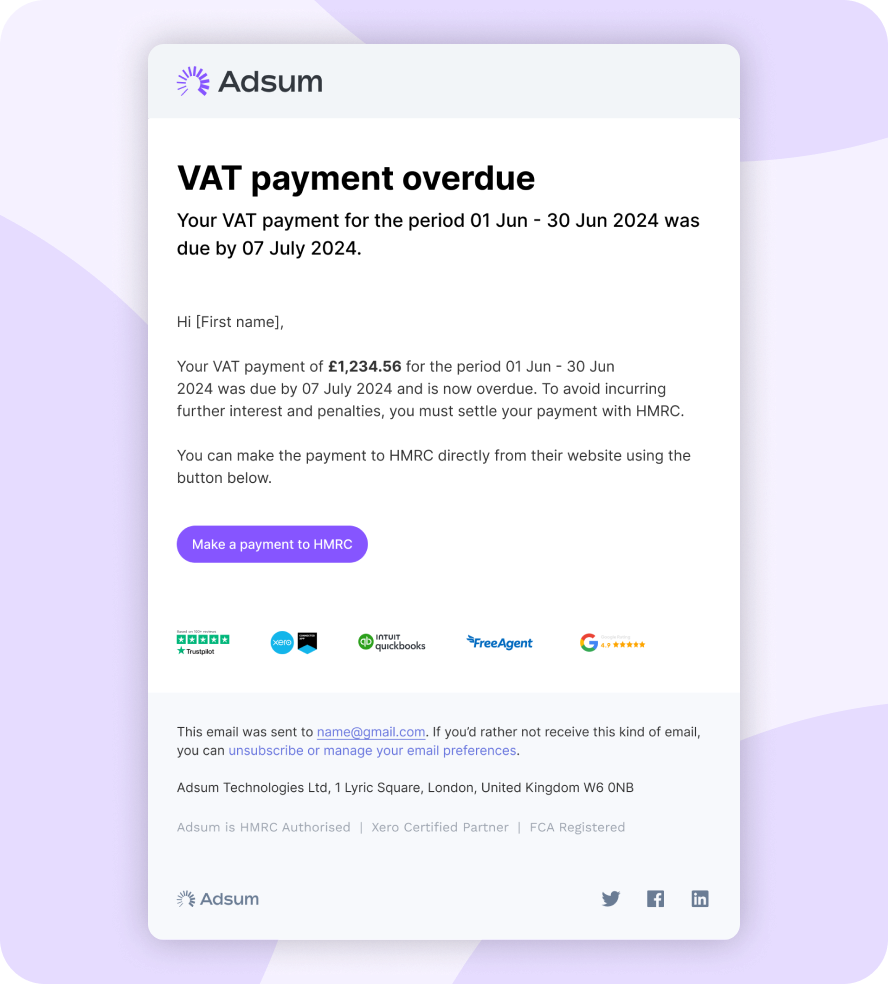

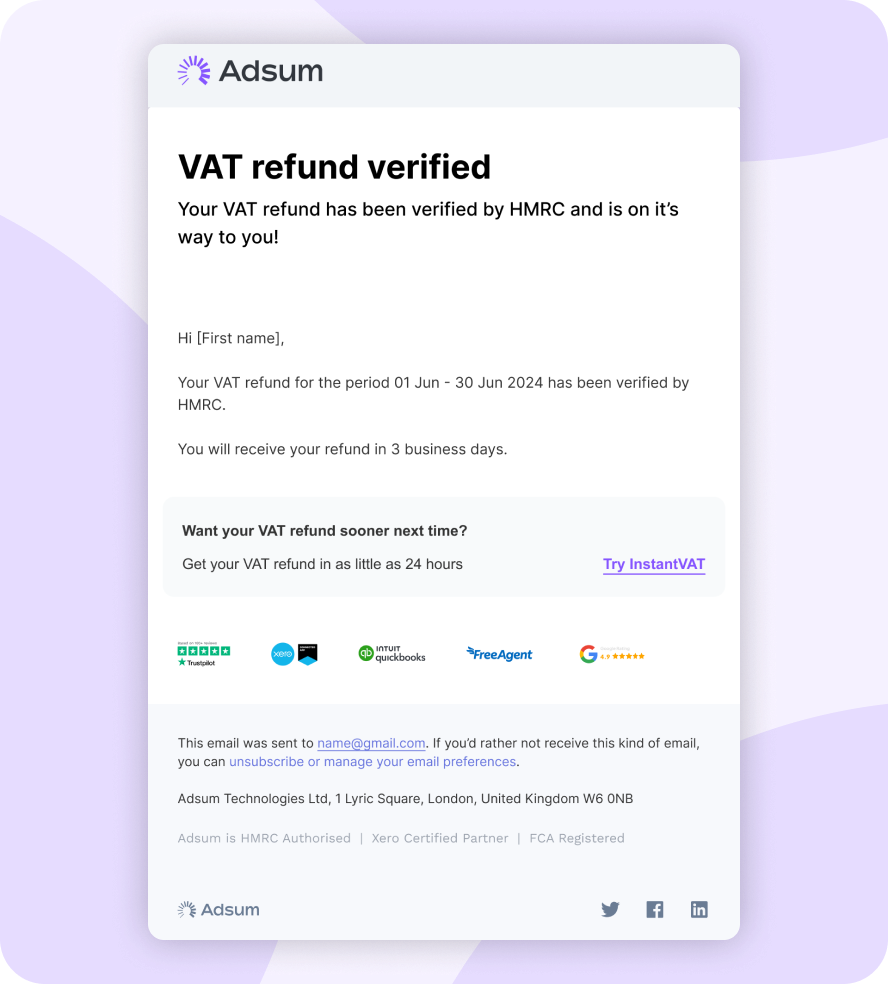

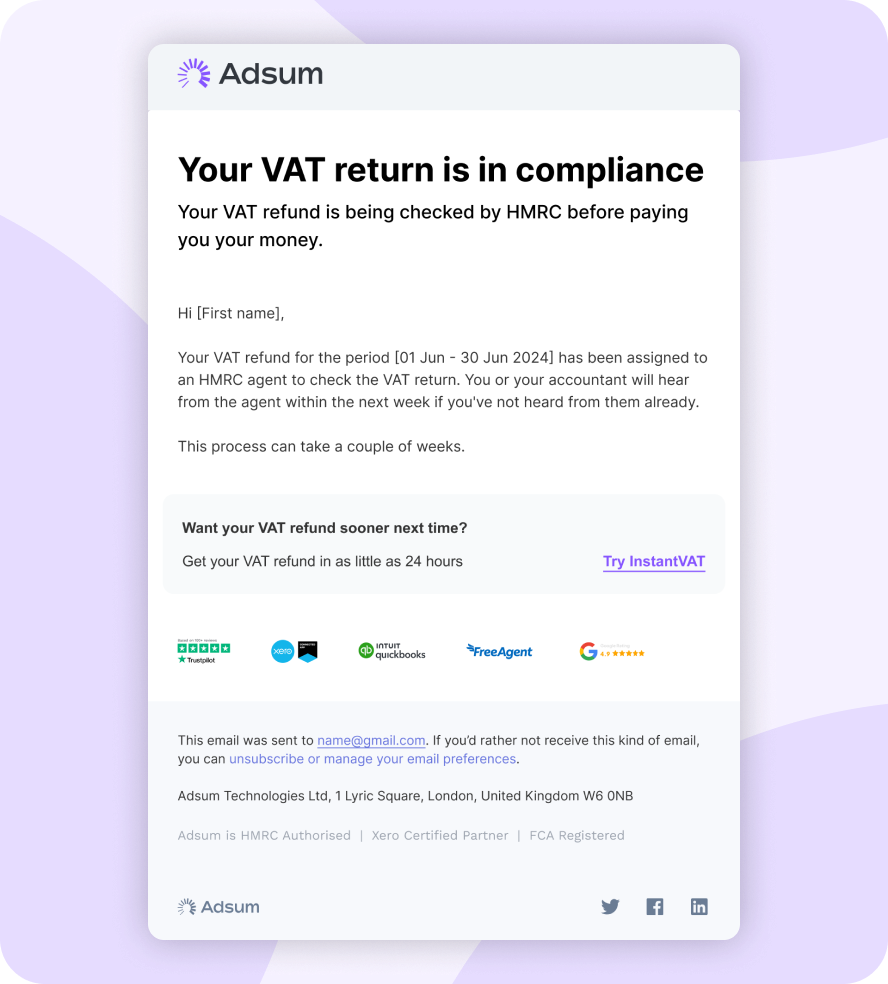

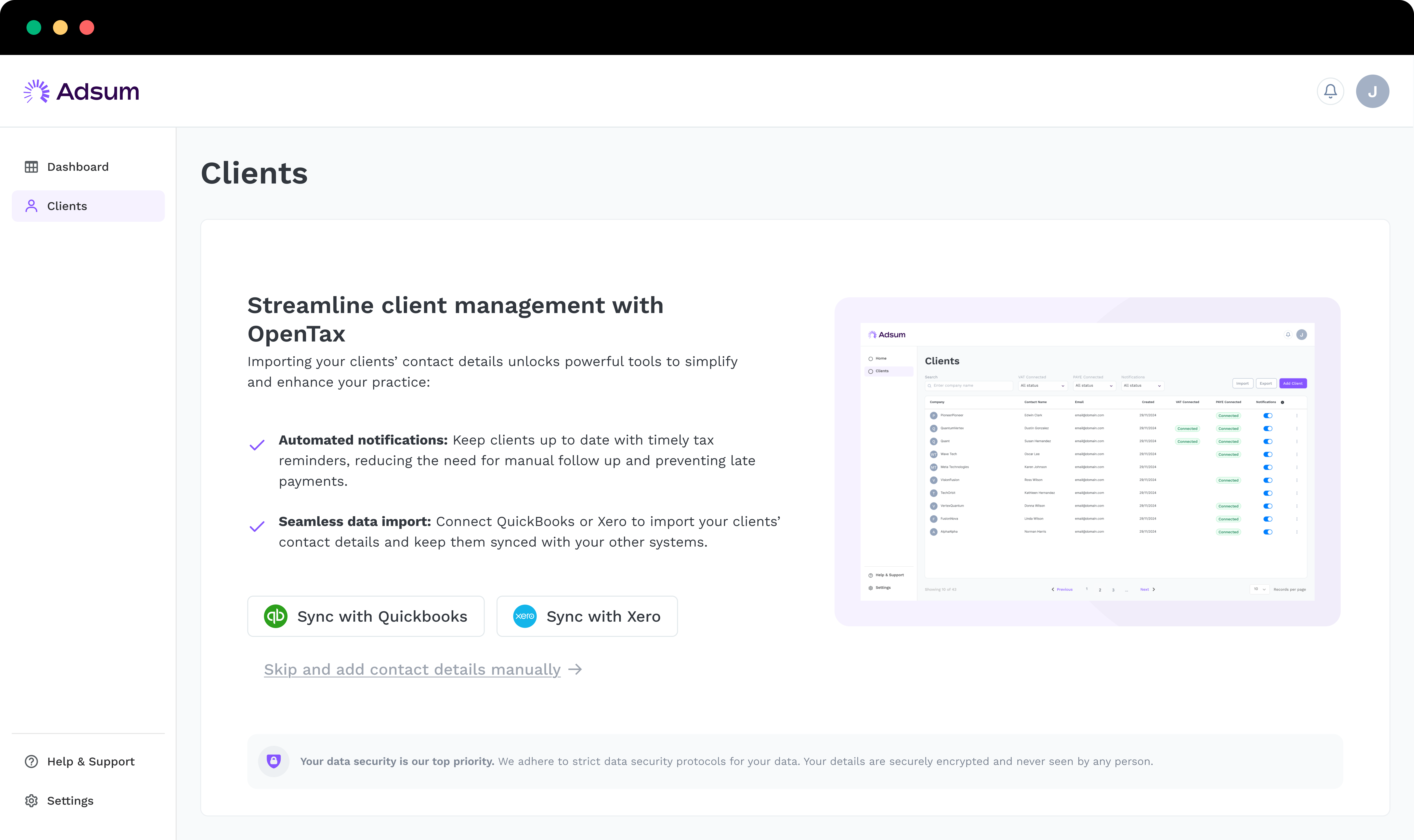

Managing client deadlines for VAT and PAYE can be time-consuming. That’s why we’ve launched client notifications in OpenTax – an automated way to send your clients reminders about key VAT and PAYE payment deadlines.

-

- Prevent late payments without constant follow-up.

-

- Save time spent chasing clients manually.

-

- Keep clients informed with automated notifications on upcoming payments due, outstanding balances, and newly filed returns.